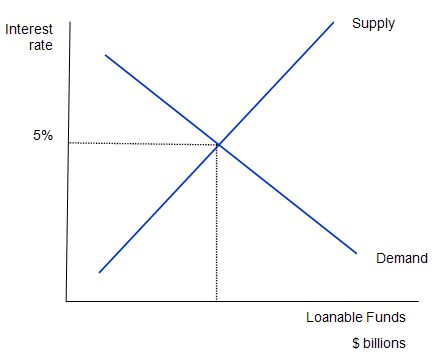

The loanable funds market (3/23)

•The market where savers and borrowers exchange funds (QLF) at the real rate of interest (r%)

•The demand for loanable funds, or borrowing comes from households, firms, government and the foreign factor. The demand for loanable funds is in fact the supply of bonds.

•The supply of loanable funds, or saving comes from households, firms, government and the foreign sector. The supply of loanable funds is also the demand for bonds.

•demand for loanable funds = borrowing (ie supplying bonds)

•more borrowing = more demand for loanable funds (->)

•less borrowing = less demand for loanable funds (<-)

Examples

•government deficit spending = more borrowing = more demand for loanable funds

•less investment demand = less borrowing = less demand for loanable funds

Changes in supply of loanable funds

• supply of loanable funds = Saving (ie demand for bonds)

• more saving = more supply of loanable funds (->)

•less saving = less supply of loanable funds (<-)

Examples

• government budget surplus = more saving = more supply of loanable funds

• decrease in consumers' MPS = less saving = less supply of loanable funds

•When government does fiscal policy, it will affect the loanable funds market

•changes in the real interest rate (r%) will affect gross private investment.

No comments:

Post a Comment