Time value of money (3/4)

Is a dollar today worth more than a dollar tomorrow?

Yes.

Why?

Inflation and opportunity cost.

This is the reason for charging and paying interest.

V= future value of $

P= present value of $

R= real interest rate (nominal rate-inflation rate) expressed as a decimal.

N= years

K= number of times interest is credited per year.

The simple interest formula

• v= (1+r) ^n •p

The compound interest formula

• v= (1+r/k)^nk•p

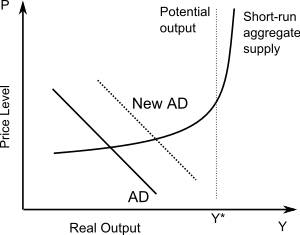

Monetary equation of exchange

•MV=PQ

-M= money supply (M1 or M2)

-V= money's velocity (M1 or M2)

-P= price level (PL on the AS/AD diagram)

-Q= real GDP (sometimes labeled Y on the AS/AD diagram)

Functions of the FED

•it issues paper currency

•sets reserve requirement and holds reserves of banks

•it lends money to banks and charged them to interest

•they are check clearing service for banks

•it acts as personal bank for the government

•supervises member banks

•controls the money supply in the economy

Banks and the creation of money

How do banks "create" money?

By lending out deposits that are used multiple times.

Where do the loans come from?

From depositors who take cash and place it in their banks.

How are the amounts of potential loans calculated?

Using their bank balance sheet, or T-accounts that consist of assets and liabilities for banks.

Bank liabilities (he right side of the T account sheet)

#1 = demand deposits (DD) or checkable deposits

- cash deposits from the public

- they are liabilities because they belong to depositors

#2 =owners equity (stock shares)

-they are values of stocks held by the public ownership of bank shares.

Key concept for AP concerning liabilities

-if demand deposits come from someone's cash holdings, then the DD is already part of money supply.

- if the demand deposit comes from the purchase of bonds (by FED) then this creates new cash and therefore creates new money supply (M1)

Bank assets (left side of T account sheet)

#1) required reserves (RR)

- these are the percentages of demand deposits that must be held in the vault so that some depositors have access to their money.

#2) excess reserves (ER)

- these are the source of new loans. These amounts are applied to the monetary multiplier / reserve multiplier (DD=RR plus ER)

#3) bank property holdings (buildings and fixtures)

#4) securities (federal bonds)

- these are bonds purchased by the bank, or new bonds sold to the bank by the Federal Reserve. These bonds can be purchased from the bank, turned into cash that immediately becomes available as "excess reserves"

#5) customer loans

-these can be amounts held by banks from precious transactions, owed to the bank by prior customers.

Money creation

• banks want to create profit. They generate profit by lending the excess reserves and collecting interest. Since each loan will go out into customer's and business' accounts, more loans are created in decreasing amounts (because of reserve requirement)

A rough estimate of the number of loan amounts created by any first loan is the "money multiplier"

• The money multiplier - a.k.a Checkable Deposits Multiplier, Reserve multiplier, Loan multiplier

Formula: 1 / the reserve requirement (ratio)

- RR = 10% = 1/.1 = Monetary multiplier of 10

• Excess reserves are multiplied by the multiplier to create new loans for the entire banking system and this creates new Money Supply